In this post, I would like to explore some possible reasons why people are often hesitant to talk openly about money.

For example we get access to public data such as job salary ranges or what minimum wage and median income is. But very rarely, if at all, do we share information with our peers about the true costs of living, lifestyle costs, debt loads, what we really need for retirement, and beyond.

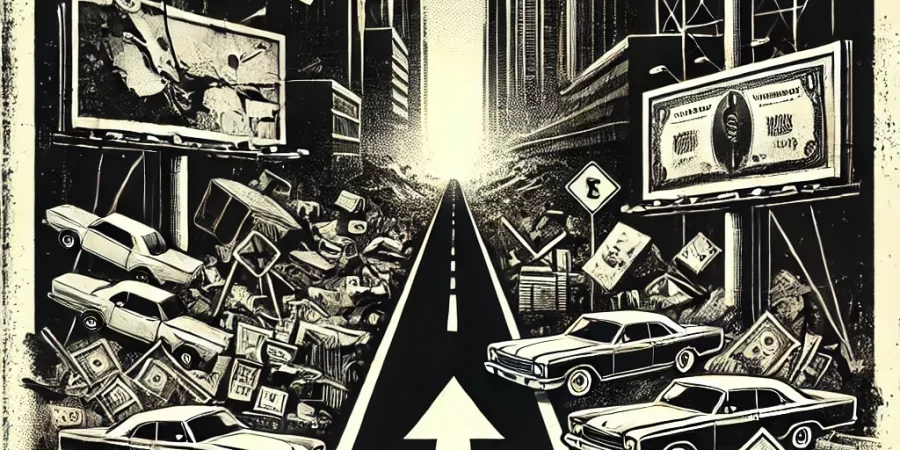

What has always seemed really weird to me is that money is a tool that is so intertwined with our daily lives, and holds significant power and influence - YET, it is often shrouded in a veil of secrecy.

Why do so many people feel so uncomfortable, or even afraid, to discuss money topics openly?

I guess it could be explained as social taboos or cultural norms, and many factors could contribute to hesitation surrounding money conversations.

So, this article is a follow up to “Calling you out because this is URGENT” and I wanted to explore various reasons why I believe that we seem to have a collective discomfort about money conversations, and the effect it has on our financial well-being.

1. Privacy:

It baffles me how in our current culture there seems to be this habit of oversharing the glamorous, best life moments on social media, yet money remains such a private matter.

Maybe it’s because discussing personal finances requires us to be a little vulnerable and trusting.

Remaining private about money matters can act as a shield, and guard us against potential judgment. When we share details about our financial situation it can feel intrusive and expose us to risks we're not willing to take.

For example if we are struggling with finances, we may be reluctant to share that information because of feeling embarrassed, or ashamed, or even that we may get taken advantage of.

And for those who are doing very well, especially business owners who rely on paying others lower wages, they likely don’t want to be seen as a target.

Lower wages only continue to work if the people receiving them don’t understand how much it hurts them. So why would business owners ruin a good thing by talking about real money requirements or educating their employees? That would be like "letting their secret out", right?

Or worse, maybe business owners (especially small business owners) just don't know those financial requirements themselves. And because of their own egos and inability to admit that they are wrong, they just continue to operate on "common" knowledge. Thus, dragging everyone else that they hire, along with them on a downward spiral.

2. Comparison Traps:

Money discussions can trigger social comparisons, and create feelings of inadequacy or envy. When confronted with someone else's financial success, we may question our own achievements and self-worth.

The fear of being judged or labeled based on our financial standing fosters a sense of discomfort, leading us to avoid these conversations altogether.

This leads us right back to privacy. We want to talk about it, but at the same time we have a contradicting desire to keep quiet about it.

3. Cultural Norms:

Cultural norms vary across societies, and so do attitudes towards discussing money. Particularly in the United States, financial success is often tied to the ideal of the "American Dream." When we admit to financial struggles it can be seen as contradicting to this narrative.

Could this potentially lead to feelings of shame or failure? Could these expectations be reinforcing our silence surrounding money matters?

I mean, if so many hard working immigrants move to the United States and become financially free, then why aren’t we doing the same as native born Americans who have been blessed with boundless opportunities right at our fingertips?

If we are struggling, then obviously it must just mean we are losers and not working hard enough… right? (Sarcasm)

4. Emotional Baggage:

Money carries emotional weight and we often tie it to our sense of security, self-worth, and success. Discussing finances can unearth deeply rooted feelings of shame, embarrassment, or anxiety.

Money-related stressors may bring up memories of past financial hardships or trigger conflicts with our family.

This just further intensifies the emotional discomfort associated with these conversations so we just sweep them under the rug and hope to not be faced with them.

5. Knowledge Gaps:

Financial literacy levels vary widely, and many individuals lack the necessary knowledge to engage in confident discussions about money.

In our society where personal finance education is often inadequate, maybe people just fear they will appear ignorant or inferior when talking about financial topics.

This knowledge gap contributes to the overall discomfort and avoidance of money conversations.

While I can’t exactly claim to have an advanced level of financial literacy, it has become part of my mission to help others increase their own financial literacy.

This is just one reason why I’ve been writing so many of these posts and lessons. I’ve realized that a lot of it is not that complicated, and is really just 4th or 5th grade math and taking the time to do some work.

6. Belief Systems:

Unspoken beliefs and superstitions surrounding money exist in many cultures. These beliefs, whether logical or not, can impact how openly we discuss finances.

Some individuals adhere to superstitions that speaking about money attracts bad luck or jeopardizes their financial well-being. I would go as far to say that some people believe that if you are struggling and they are not, that you will infect them with your “unluckiness” just by talking about it, and they will avoid you like the plague.

While these beliefs may seem irrational, they contribute to the silence surrounding money matters.

7. Stigmas of Financial Struggles:

Acknowledging financial difficulties requires vulnerability, and there's often a stigma attached to struggling with money.

People experiencing financial hardships may fear being judged, pitied, or seen as failures.

This fear of judgment discourages open conversations about financial struggles, perpetuating the silence and hindering the support individuals might receive.

8. Materialism:

In Western societies, many people have been trained to believe that discussing money can be perceived as being materialistic or greedy.

We feel that openly talking about financial goals or aspirations may result in others viewing us as materialistic or they will believe that we are solely focused on wealth accumulation.

A common statement that we see used by companies is the gaslighting statement used on prospective employees that is something along the lines of:

“if we’re only after the paycheck then we aren’t a good fit and probably not passionate about our work or the cause”.

To avoid this label, many of us choose to keep money conversations at bay, prioritizing other aspects of our lives to talk about instead.

9. Workplace Power Dynamics:

In the realm of employment, discussions about salaries and income are often discouraged. Employers may intentionally create a culture of secrecy to create a divide and prevent workers from gaining collective bargaining power.

The lack of transparency around salaries (and how they affect our ability to live a good life) contributes to the discomfort of discussing money openly. As a result, individuals fear the potential consequences of exposing their income or negotiating power.

I always imagine that business owners and corporate executives have this unspoken idea that if people don’t talk about it then maybe they won’t realize what they are missing. And who wants to ruin a good thing right? As long as the workers keep competing against each other, they won’t question or bite the hand the feeds, right? (sarcasm)

Conclusion:

Most of us know that money is a topic that affects us all, yet talking about it openly and logically seems to be continually frowned upon in our society.

Privacy concerns, social comparisons, cultural norms, and emotional baggage all contribute to our hesitancy surrounding money conversations.

However, acknowledging and addressing these barriers is also very important for our financial well-being.

By fostering open and supportive conversations around money, we can empower ourselves, enhance financial literacy, and reduce the stigma associated with financial struggles.

Let's try to break some of the silence and start talking a little more about money.

I’d be willing to bet that most us have a desire to live a good life, and discussing financial needs and goals can give us all a better understanding of what we need to get there and pave the way for a healthier and more transparent financial future.

Especially for our children and grandchildren.

One Response